This is not a time for a “white flag!” Life insurance settlements must become a reality in all of Canada, sooner versus later

I have never been a white flag type of guy. I believe when the cause is right, quitting is not an option. And the cause that I have been pursuing, on behalf of Canadian seniors, for more than two years is right! I’ve written a book, met with numerous politicians and staff, submitted extensive documentation to government agents, communicated with many in the life insurance industry, contacted the press, had interviews, written articles, founded the Life Insurance Settlement Association of Canada … and after two years, little has changed.

I am taking up a red flag and I intend to carry it until this critical issue is resolved. And I’ll do it on my own if I must. Like Howard Beal said in the 1976 movie, Network, “Things have got to change … I’m as mad as hell, and I’m not going to take this anymore!”

This is wrong

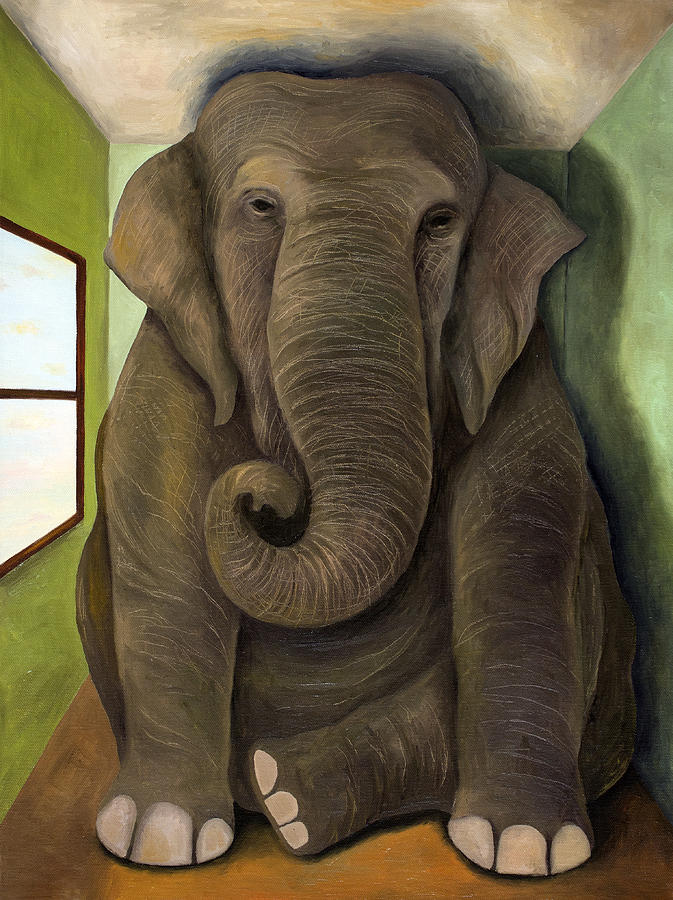

Six provinces in Canada prevent their residents from being able to receive fair market value for their life insurance policies if they choose to sell them and this violates a fundamental principle of a free market system. In Ontario, under the Ontario Insurance Act, there is a regulation (Section 115) that states that to buy life insurance policies from willing sellers is “trafficking” and a criminal offense. I suggest that that regulation is a violation of a person’s rights and the rights of both a seller and buyer to receive fair market value.

The Canadian Income Tax Act defines fair market value as follows:

The price a willing purchaser will buy from a willing seller in an unrestricted and open market, with neither party being under undue pressure.

Initially, my focus has been in Ontario with it’s more than two million seniors and my point is simple:

The need for consumers to receive a fair market value for an asset they own, a life insurance policy, is a fundamental right, which currently is not available to Ontarians. Fair market value is a cornerstone of any financial sector and economy and yet, for decades seniors have been prevented from receiving the fair market value for this important asset. Basically, life insurance companies are the only buyers of policies – that’s called a monopoly – and in many cases the only alternative to selling is to let the policy lapse. The absence of a secondary market has allowed this unfair, monopolistic practice to continue for decades. Furthermore, one of the best ways of protecting consumers from monopolistic and predatory practices is to provide a well-regulated, fair and competitive marketplace.

I have spoken to hundreds of seniors and they are as perplexed and concerned as I am. Outraged that those who preach helping and protecting them (insurers and government agencies – FSCO) have done nothing for over twenty years. Unfortunately, only a small percentage of the tens-of-thousands who might choose a life settlement as an option are aware of this egregious undermining of their rights – not to mention perpetuating a barrier to their financial well-being. Therein lies the problem. Seniors don’t know about this option and no one is offering them the opportunity to learn more and explore alternatives.

I intend to change that

I am going to take the message directly to the public and offer seniors an opportunity to understand life settlements, weigh their options and if they choose, sell their policy – to me! In other words, I plan to offer a fair market value purchase of a senior’s qualifying life insurance policy, likely at a far greater value than they would receive from their life insurance company. If that’s considered “criminal,” so be it.

Enough is enough! Someone has to do what is right for Canadian seniors.

In the weeks ahead, we will be inviting those who agree with the need to create a competitive market to join us in this on going battle for seniors’ rights. If you would like news and information from the Life Insurance Settlement Association of Canada (LISAC) send your email address to: info@hereliesyourmoney.com

In the weeks ahead, we will be inviting those who agree with the need to create a competitive market to join us in this on going battle for seniors’ rights. If you would like news and information from the Life Insurance Settlement Association of Canada (LISAC) send your email address to: info@hereliesyourmoney.com

If anyone, including the many members of seniors’ organizations like Probus and CARP, would like to know if their policy qualifies for a life settlement and what its fair market value could be, I’d be more than happy to provide you with an estimate – no charge.

If anyone, including the many members of seniors’ organizations like Probus and CARP, would like to know if their policy qualifies for a life settlement and what its fair market value could be, I’d be more than happy to provide you with an estimate – no charge.

Contact: 416-368-5351 x 226 Email: agoodm5702@rogers.com

Apparently, for Bill 177, there will be a new sheriff in Saskatchewan’s wild wild west, a Ms. Janette Seibel, a lawyer with FCAA. This could be good. Plus the fact that the process for changes to Bill 177 is still open. The wheels of government grind slowly and Bill 177 will not be enacted until late 2016 or early 2017 so that provides time for the introduction of new regulations that can clarify and override the current Bill as it stands.

Apparently, for Bill 177, there will be a new sheriff in Saskatchewan’s wild wild west, a Ms. Janette Seibel, a lawyer with FCAA. This could be good. Plus the fact that the process for changes to Bill 177 is still open. The wheels of government grind slowly and Bill 177 will not be enacted until late 2016 or early 2017 so that provides time for the introduction of new regulations that can clarify and override the current Bill as it stands. Meet the Chair of the Conservative Party’s insurance caucus, Peter Braid

Meet the Chair of the Conservative Party’s insurance caucus, Peter Braid “Give people options … voluntary choices”

“Give people options … voluntary choices” To lead or avoid change?

To lead or avoid change?

There is no shortage of documentation to show that the Mike Harris Conservative Government accepted the merits of a well-regulated life settlement industry (called viatical settlements at the time) and recommended going forward.

There is no shortage of documentation to show that the Mike Harris Conservative Government accepted the merits of a well-regulated life settlement industry (called viatical settlements at the time) and recommended going forward. Somebody in the FSCO hen house is selling somebody a “bill of goods” that is not good for seniors. And it’s got something to do with the foxes – in this case, the insurance companies and their lobby. Because someone in the “hen house” has been sitting on what could be a golden egg for seniors for 15 years. FSCO has not yet done the right thing and the likely excuse will probably be related to the insurance industry not yet having provided “comments” on the government recommendations and intentions in 2000. Or some other irrational excuse.

Somebody in the FSCO hen house is selling somebody a “bill of goods” that is not good for seniors. And it’s got something to do with the foxes – in this case, the insurance companies and their lobby. Because someone in the “hen house” has been sitting on what could be a golden egg for seniors for 15 years. FSCO has not yet done the right thing and the likely excuse will probably be related to the insurance industry not yet having provided “comments” on the government recommendations and intentions in 2000. Or some other irrational excuse.

Four times the cash value

Four times the cash value Pre-election budget to benefit seniors

Pre-election budget to benefit seniors

The media?

The media? Opportunity – it’s election time

Opportunity – it’s election time Advocacy?

Advocacy?